Introduction:

Form ITR 7 is a critical component of the tax filing process for Non-Profit Organizations (NPOs), including charitable organizations, under Section 139(4A)/ (4B) / (4C) / (4D) of the Income Tax Act, 1961. This article is aimed to be guide to Income tax return which is required to be filed in Form ITR 7, highlighting its significance, key deadlines, implications of non-compliance, associated penalties, and the common challenges faced by NPOs along with potential solutions.

1. Background

Form ITR-7 is updated periodically to align with changes in tax laws and regulations. It is important to check for the latest version and instructions to ensure compliance : Access the latest Utilities

Recently, the Central Board of Direct Taxes (CBDT) has notified updated Form ITR 7 for Assessment Year 2024-25, vide Notification No. 24/2024 dated 01-03-2024 reflecting changes aimed at improving transparency and compliance for charitable trusts, religious trusts, and other institutions referred to as 'charities'.

2. What is an Income Tax Return - Form ITR 7?

The Form ITR 7 encompasses a wide range of information that must be provided about a charitable organization's income, expenses, assets, liabilities and other mandatory disclosures. It includes various schedules that capture details such as the entity's general information, member details, donation and application specifics, and other compliance-related aspects

3. Who is required to file Form ITR 7 and why is it important?

Form ITR 7 must be filed by all charitable and religious trusts/companies with valid registrations under sections 12AB or 10(23C) of the Income Tax Act, 1961. It is required to be filed to seek tax exemptions under sections 10(23C), 11 and 12 of the Income Tax Act, 1961.

Filing ITR-7 correctly is crucial for claiming tax benefits and maintaining transparency. It is also essential for securing grants and funding as these documents do form a part of due-diligence process/proposal submission while seeking funds from donors.

4. Disclosures requirements

The Form ITR 7 is detailed and includes numerous disclosure requirements. It primarily consists of several parts and schedules, covering the following relevant key elements-

Part A: General information- which includes the basic information about the entity such as personal information, projects run by the organization, registration details , projects/ institutions having one of the charitable purposes as advancement of any other object of general public utility, any change in the objects/activities, audit information, members Information, etc.

Part B: Relevant Financial Information and Schedules to the return forms have been given below*:

Schedule I- Details of amounts accumulated / set apart within the meaning of section 11(2)

Schedule IA- Details of accumulated income taxed in earlier assessment years as per section 11(3)

Schedule D- Details of deemed application of income under clause (2) of Explanation 1 to sub-section (1) of section 11

Schedule DA- Accumulated income taxed in earlier assessment years as per section 11(1B).

Consolidated Balance Sheet-Sources of Funds & Application of funds

Schedule R-Reconciliation of Corpus of Schedule J & Balance sheet

Schedule VC- Voluntary Contributions

Schedule K- Disclosure of Income and Expense

Schedule AI- Aggregate of income referred to in section u/s 11 and 12 derived during the previous year excluding Voluntary contribution forming part of corpus as per section 11(1)(d) and voluntary contributions

Schedule A- Amount applied to stated objects of the trust/institution during the previous year

Schedule IE- Income & Expenditure statement if applicable

Other Schedules- House Property, Capital Gains, Virtual Digital Assets, Income from other sources, General, Business profession, Details of Income after set-off of current years losses where applicable

Schedule 115TD- Accreted income (Exit Tax) under section 115TD if applicable

Part B-TI- Statement of Income

Part B TTI- Computation of tax liability on total income

*Please note that this is a summary of relevant schedules and the actual reporting requirements may be extensive, depending on the applicability of additional schedules.

5. Key-points on Compliance dates:

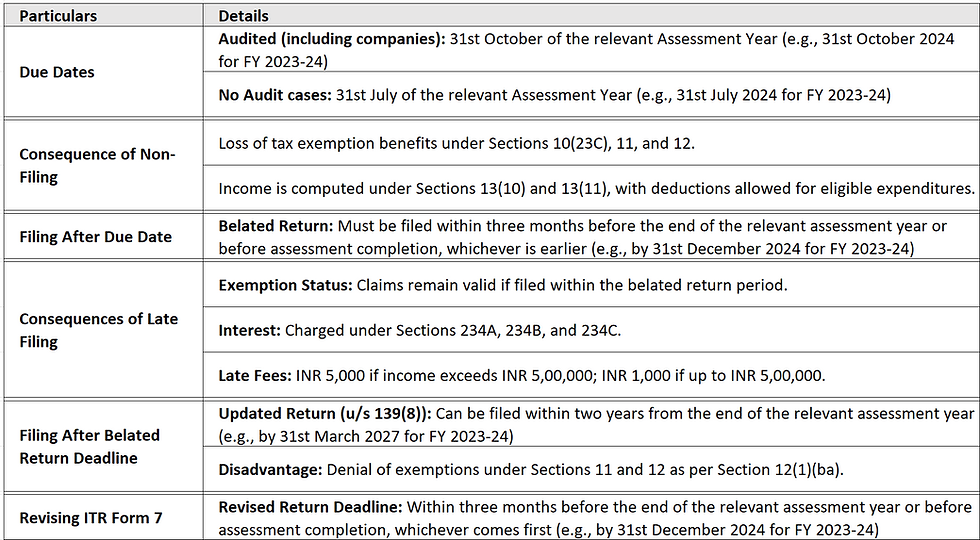

The below table provides a concise overview of important deadlines and consequences.

Note: If you receive an intimation under Section 143(1) of the Income Tax Act, 1961, any errors in the Income Tax Return must be corrected through a rectification request, as stipulated under Section 154 of the Act.

6. Top 5 Common mistakes in filling the ITR Form 7:

When completing ITR Form 7 for trusts and charitable institutions, avoid these common errors:

Incomplete Registration Disclosure: List all relevant registrations and approvals under the Income Tax Act and other laws to maintain compliance.

Wrong Bank Account Details: Double-check bank account information to avoid issues with refunds or transactions.

Missing Substantial Contributions: Failing to report large contributions as required under Section 13(3)(b) can lead to compliance issues.

Misstated Applied Amount: Ensure accurate reporting of amounts applied to your trust’s objectives during the financial year.

Incorrect Income Allocation: Incorrect presentation of how income applied to the trust's stated objectives is reported, whether from current year earnings or accumulated from previous years.

7. When is the filing of ITR Form 7 considered to be complete?

Filing ITR Form 7 is considered complete when:

The form is accurately filled and submitted via the Income Tax e-filing portal.

The return is verified, which can be done electronically using Aadhaar OTP, net banking, or a digital signature. Alternatively, a signed copy of the ITR-V (Acknowledgement) must be mailed to the Centralized Processing Center (CPC) within 30 days if not using electronic methods.

An acknowledgment receipt is generated after submission and verification.

Attachments Required: Generally, no documents need to be attached with Form 7 at the time of submission. However, it is important to retain all supporting documents, including those specified under Rule 17AA of the Income Tax Rules, 1962. These documents may be requested by the Income Tax Department or needed during an audit.

8. Challenges for NPOs in Filing Correct Income Tax Returns:

Non-Profit Organizations (NPOs) often face several challenges in filing accurate income tax returns:

Complex Regulations: Navigating the complex tax laws and compliance requirements can be overwhelming.

Accurate Reporting: Ensuring precise allocation of income and expenditures as per regulatory requirements.

Documentation: Maintaining and organizing extensive documentation for various schedules and disclosures.

Changes in Tax Laws: Staying updated with periodic changes in tax regulations and requirements.

Resource Constraints: Limited financial and administrative resources can hinder effective tax filing.

Conclusion:

Navigating the complexities of Form ITR 7 not an easy task. It is essential for NPOs to ensure timely and accurate compliance to continue to avail tax exemption status. With frequent updates and detailed requirements, it’s crucial to avoid common pitfalls and adhere to deadlines.

How can Aria help?

Aria CFO Services offers specialized services to assist NPOs in overcoming their challenges:

Expert Guidance: Providing detailed advice to navigate complex tax regulations and compliance requirements.

Accurate Reporting: Assistance in creating an accurate framework for allocation of income and expenditures, ensuring adherence to regulatory standards such as FCRA, Income Tax, CSR, Companies law, local Trust laws, etc.

Regulatory Updates: Keeping clients informed about the latest changes in tax laws and how they impact their filing.

Resource Support: Offering support to maximize the efficiency of tax filing processes, allowing NPOs to focus on their core activities.

Connect with us and schedule a consult.

Comments